BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>5 Stocks Poised for Breakouts

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>5 Rocket Stocks Worth Buying Now

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

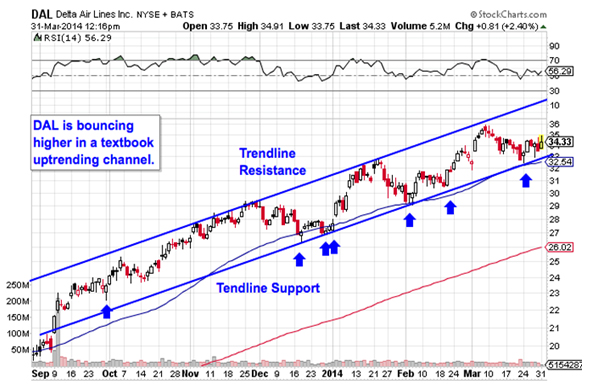

Delta Air Lines

Nearest Resistance: $39

Nearest Support: $32.50

Catalyst: Technical Setup

You don't have to be an expert technical analyst to figure out what's going on in shares of Delta Air Lines (DAL). A quick look at the chart will do. Delta is up on big volume this afternoon, the latest bounce in a price channel that's been corralling shares for the last six months and change. Delta is a "buy the dips stock," and March's dip is providing investor with another buying opportunity this week.

The 50-day moving average has been an excellent proxy for support all the way up; if you decide to buy Delta here, I'd recommend putting a protective stop on the other side of that 50-day line.

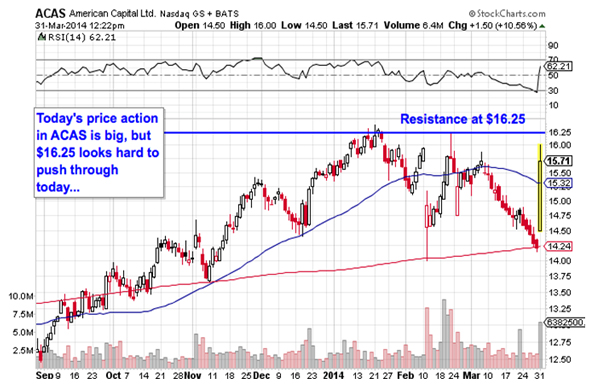

American Capital

Nearest Resistance: $16.25

Nearest Support: $14.24

Catalyst: Share Repurchase

Shares of mid-cap asset manager American Capital (ACAS) are rallying more than 11% in this afternoon's trading, following news that the firm had repurchased 8.9 million shares. Make no mistake, the repurchase was just the catalyst for a buying frenzy that was already on a hair trigger -- that buyback wasn't material enough to cause such a big move, but buyers were looking for any excuse to jump in here.

From a technical standpoint, it doesn't make a whole lot of sense to join them just yet. ACAS has pushed its was up close to previous resistance at $16.25, a price level that's going to provide some resistance to this stock's upside in April. There's a lot of downside risk and not a whole lot of upside reward following today's big-volume move.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>3 Stocks Rising on Unusual Volume

>>Beat the S&P in 2014 With 5 Stocks Everyone Else Hates

>>5 Stocks With Big Insider Buying

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment