Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does British Petroleum (NYSE: BP ) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

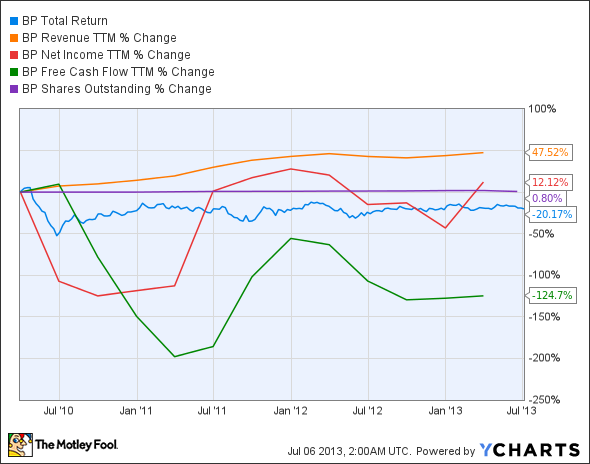

The graphs you're about to see tell BP's story, and we'll be grading the quality of that story in several ways:

What the numbers tell you

Now, let's take a look at BP's key statistics:

BP Total Return Price data by YCharts

| Revenue growth > 30% | 47.5% | Pass |

| Improving profit margin | (24%) | Fail |

| Free cash flow growth > Net income growth | (124.7%) vs. (12.1%) | Fail |

| Improving EPS | 10.5% | Pass |

| Stock growth (+ 15%) < EPS growth | (20.2%) vs. 10.5% | Pass |

Source: YCharts.

*Period begins at end of Q1 2010.

BP Return on Equity data by YCharts

| Improving return on equity | (7.4%) | Fail |

| Declining debt to equity | 15.7% | Fail |

| Dividend growth > 25% | 28.6% | Pass |

| Free cash flow payout ratio < 50% | Negative FCF | Fail |

Source: YCharts.

*Period begins at end of Q1 2010.

How we got here and where we're going

BP doesn't quite come through with flying colors, as it's only earned four out of nine possible passing grades. A big source of weakness is the company's falling free cash flow, which has diverged markedly from its net income over the past three years, and which may not be able to support its current dividend payouts if the trend continues. Will BP be able to move past this problem, or is the oil and gas supermajor going to be tarnished for some time to come? Let's dig a little deeper.

All of the major oil and gas companies have been at the mercy of sluggish economic growth and dwindling global demand for their products, and BP is certainly no different. Global energy consumption grew by only 1.8% in 2012, well below the 10-year average of 2.6%. Emerging market economy demand, which has been typically driving consumption growth, is now almost exclusively dependent on China and India; together, the demand from these two countries accounted for almost 90% of the global increase last year.

BP has certainly seen better days, but it was beaten up quite a bit over its oil spill fiasco in the Gulf of Mexico. The company may find itself paying billions of dollars more in damages than it's already been forced to pay. A conviction for gross negligence could cost BP up to $17 billion, not including unspecified punitive damages by claimants who didn't get their piece of the first $8.5 billion settlement BP paid out last year.

Over the next decade, BP plans to direct as much as 75% to 80% of its capital expenditures toward upstream projects. This focus will be aimed at operations in Angola, Azerbaijan, the North Sea, and the Gulf of Mexico, where BP has more than 40 major projects. These four regions combined should generate roughly half of the BP's operating income by 2020. In a recent announcement, BP, ExxonMobil (NYSE: XOM ) , and ConocoPhillips (NYSE: COP ) combined to invest another $1 billion in the North Slope of Alaska over the next five years. This decision was spurred by recently passed tax reforms that make drilling in the region more attractive to oil companies. The three companies are also mulling a plan to drill more wells and remove bottlenecks from current facilities in the area, and this expansion would require an additional $3 billion in capital investment.

Investors in BP today would be paying just a bit over eight times current-year forecast earnings, and might expect to see strong earnings growth of 40% by year-end. BP's dividend is also quite appealing: its yield is over 5%, and been growing strongly since reinstatement after a period of nonpayment during the Gulf of Mexico disaster. BP's valuation makes it an interesting proposition for investors willing to take on a higher risk of litigation pain for a potentially higher return.

Putting the pieces together

Today, BP has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

There are many different ways to play the energy sector, and The Motley Fool's analysts have uncovered an under-the-radar company that's dominating its industry. This company is a leading provider of equipment and components used in drilling and production operations, and poised to profit in a big way from it. To get the name and detailed analysis of this company that will prosper for years to come, check out the special free report: "The Only Energy Stock You'll Ever Need." Don't miss out on this limited-time offer and your opportunity to discover this under-the-radar company before the market does. Click here to access your report -- it's totally free.

No comments:

Post a Comment