Microsoft's (MSFT) valuation increased substantially after reaching a low at the end of 2012. With that in mind, it is time to review the software developer. How should investors be positioned? What are some of the latest press releases and rumors circulating about the tech giant? The goal is to determine how recent developments impact the short-term and long-term outlook for the business.

The first section will discuss some of the recent press releases and rumors. The second section will cover a recent security issuance, and the last section deals with historic and forecasted financial performance and includes some peer company comparisons.

Shares of Microsoft are trading in a zone that investors should start locking in some of their profit: whenever valuations start to reach new highs, investors should look to cash in on the recent increase. Peter Klien announced that he is leaving Microsoft.

Recent Developments

Amy Hood replaced Peter Klien as CFO of Microsoft. Hood was formerly the CFO of the Microsoft Business Division. Also, Hood worked with Goldman Sachs Group Inc. and earned her MBA at Harvard University. Based on her previous experience, Amy Hood should be an outstanding CFO.Microsoft is rumored to be working on a smaller tablet. The smaller Surface is meant to compete with the iPad Mini. The new Surface's screen resolution is rumored to be higher than the iPad Mini's screen resolution. Offering a smaller tablet should be a move in the right direction.In the first quarter of 2013, Microsoft controlled about 1.8 percent of the tablet market. That compares with Apple's near 40 percent and Samsung's near 18 percent. With worldwide tablet shipments growing at an estimated 142 percent year-over-year in the first quarter, Microsoft can increase unit shipments without having to take market share from competitors. I'm estimating unit shipments closer to 1.5 million to 2 million in the first quarter of 2014; that would be up from 900,000.Microsoft is offering to pay $1 b! illion to buy the digital assets of Nook Media LLC, the digital book and college book joint venture with Barnes & Noble and other investors. The Nook unit brought in total revenue of $1.215 billion for fiscal 2012; Microsoft's offer seems fair based on a multiplier model sales valuation. From a business perspective, the digital book and digital college book industry is in its infancy and should enter a growth stage before reaching a shakeout stage, according to the industry life cycle model.Overall, the recent developments are long-term bullish for shares of Microsoft. Next, we'll analyze a portion of recent securities issuances.

Securities Issuances

On April 25, 2013, Microsoft Corporation entered into an Underwriting Agreement for the issuances and sales of Euro 550 million 2.625 percent Notes due 2033, $450 million 1 percent Notes due 2018, $1 billion 2.375 percent Notes due 2023, and $500 million 3.750 percent Notes due 2043.

According to data collected from Bloomberg at 12 a.m. on May 9th, the yield on the U.S. Treasury 5-year was 0.75 percent; the 10-year yielded 1.81 percent; 30-year yielded 2.99 percent. The estimated yield on a U.S. 20-year security would be 2.4 percent.

| Nominal Spread | Yield Ratio | |

| 5 Year | 0.25 percent | 1.33 |

| 10 Year | 0.57 percent | 1.31 |

| 20 Year | 0.23 percent | 1.09 |

| 30 Year | 0.76 percent | 1.25 |

A linear model was used to estimate the yield of a hypothetical 20-year U.S. Treasury security; based on the results of the model, the yield would likely be lower than the model's estimate. I would say that a nominal spread of roughly 50-60 basis points over a hypothetical U.S. Treasury would be a fair credit spread (based on the other nominal spreads). Consequently, the yield on the hypothetical 20-year U.S. Treasury sec! urity wou! ld be roughly 2 percent to 2.1 percent. The yield ratio for Microsoft's 20-year issue would be between 1.25 and 1.31.

Although the nominal spread is relatively low, the 5 year and 10 year issues are attractively valued. Further, investors could be reinvesting coupon payments in a rising interest rate environment. Next is an evaluation of the historic financial performance, some forecasts and peer company comparisons.

Financial Performance

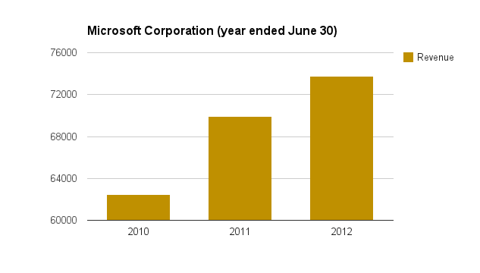

Microsoft is reporting excellent financial performance relative to peers International Business Machines (IBM) and Oracle Corporation (ORCL); all three firms compete in the software industry and broader technology sector. Microsoft's revenue grew in 2011 and 2012, and revenue is forecasted to grow in fiscal 2013.

(click to enlarge)

Microsoft's revenue is trending higher and could reach $80 billion within a few years.

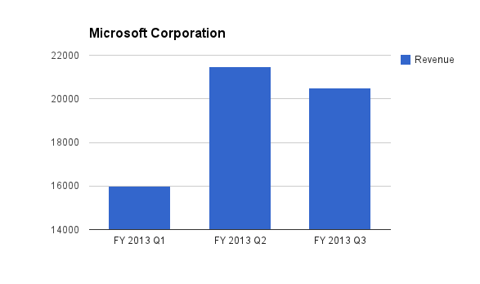

(click to enlarge)

I'm forecasting $78 billion fiscal year 2013 revenue, or about $20 billion in fiscal fourth quarter revenue.

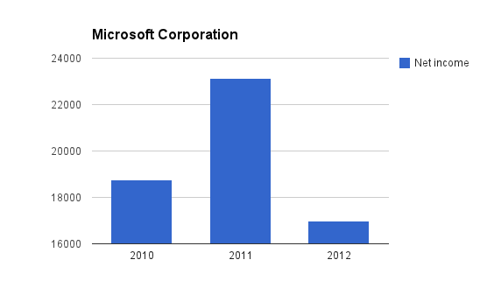

(click to enlarge)

In 2012, net income declined relative to 2010 and 2011; to the best of my knowledge, net income should rebound to over $20 billion.

IBM's revenue increased in calendar 2011 and declined in calendar 2012. In terms of revenue growth, Microsoft is outperforming IBM, but IBM did a better job managing expenses and growing the bottom line. Further, Microsoft outperformed Oracle in terms of revenue growth during fiscal 2013. Microsoft isn't being impacted by what is being described as weakness in technolog! y expendi! ture; weakness in Oracle's and IBM's top-line growth is at least partly attributable to their hardware segments.

Conclusion

Overall, I'm bullish on Microsoft long-term, but short-term there could be a share price decline. The financial performance has been relatively good, and the firm was able to issue debt at low interest rates. Also, the tablet business is showing some signs of life. Right now, Microsoft deserves its premium valuation.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment