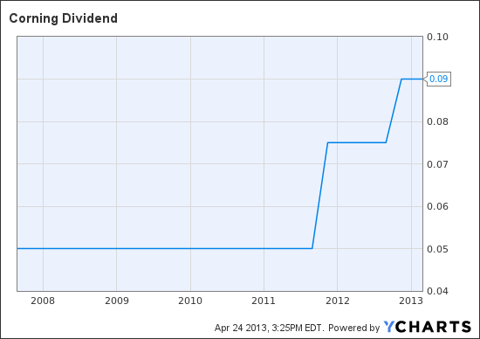

On Wednesday April 24th, Corning Inc. (GLW) announced a quarterly dividend increase of $0.01/share to bring its upcoming dividend payout to $0.10/share. It should be noted that this increase represents a 10% rise from its prior dividend of $0.09/share which was paid on January 30th. In the wake of Corning's dividend increase I wanted to examine several of the catalysts behind my decision to establish a long-term position in this particular stock.

Overview: Shares of GLW, which currently possess a market cap of $20.04 billion, a P/E ratio of 11.42, a forward P/E ratio of 10.42, and a PEG ratio of 0.95, settled at $13.88/share at the end of Wednesday's session.

(click to enlarge)

Recent Earnings: Along with the company's dividend announcement, Corning also reported Q1 results, which to most everyone's surprise were earnings of $0.30/share ($0.06/share better than street expectations) on slightly disappointing revenue of $1.8 billion (the Street was expecting $1.96 billion).

There are a few things within Wednesday's earnings announcement that strike me as very promising catalysts heading into Q2 and the remainder of the year. First let's begin with the company's Core Performance for the quarter. Comparative to Q1 2012, Core Net Sales were steady at $1.814 billion, Core Equity Earnings rose slightly to $180 million, Core Earnings rose 12% to $445 million and Core EPS rose 15% to $0.30/share.

Now let's move on to the company's GAAP Performance for the quarter, which, if you ask me, could use some improvement over the next 6-12 months. As a whole the company's performance was mixed as GAAP Net Sales and GAAP Equity Earnings demonstrated declines of 6% and 21%, respectively, while GAAP Net Income and EPS rose 6% and 4%, respectively.

What were some the factors contributing to Corning's performance? For starters, Corning's LCD unit! sales increased 7% on a year-over-year basis and contributed to 36% of the company's overall total and the unit's volume also rose by a "mid-teens" level according to an earlier Market Current. The company's telecom (optical fiber) sales fell 7%, but rose 10% in the fourth quarter and contributed 26% to the total sales of the company. Meanwhile the company's Specialty Materials (including its Gorilla Glass unit) and Environmental sales fell 10% and 13%, respectively. Lastly the company's Life Sciences segment saw sales rise impressively, which was due in large part to the company's recent M&A activity. One of the things I'd like to see in the second quarter is an improvement in the company's sales, especially in terms of its semiconductor and environmental businesses.

Dividend & Buyback Behavior: Since August 27 2007, GLW has increased its quarterly dividend a total of three times by an average of $0.0166 each time. From an income perspective, the company's forward yield of 3.00% coupled with its payout ratio (currently 27.00%) and its continued annual increases could equate into a very viable income option for long-term investors. It should also be noted that Corning announced its plans to buy back a total of $2 billion in stock by the end of the year.

GLW Dividend data by YCharts

Conclusion: When it comes to those who may be looking to establish a position in Corning, Inc., I'd continue keep a watchful eye, not only on the company's dividend behavior over the next 12 months, but any key developments with regard to the improvement of such segments as its Specialty Materials or Environmental units. If earnings continue to show strength throughout the remainder of the year and the company's revenues also improve, investors may also want to consider Corning from a growth perspective as well.

Disclosure: I am long GLW. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment